Xero accounting is way more than just software; it’s your business’s financial BFF. This guide dives deep into everything Xero, from setting up your account and mastering invoicing to crushing expense tracking and generating killer reports. We’ll unpack the features, compare it to the competition (QuickBooks, anyone?), and even spill the tea on troubleshooting those pesky issues. Get ready to level up your financial game!

Think of Xero as your all-in-one financial command center. It’s designed to simplify accounting tasks, saving you time and headaches so you can focus on what truly matters – growing your business. Whether you’re a solopreneur or managing a small team, Xero’s got your back with intuitive tools and a streamlined workflow. We’ll explore its capabilities across different business types and sizes, ensuring you understand how to leverage its full potential.

Xero Accounting Software Overview

Xero is a cloud-based accounting software designed for small and medium-sized businesses (SMBs). It offers a range of features aimed at simplifying accounting tasks, from invoicing and expense tracking to financial reporting and payroll management. Its intuitive interface and mobile accessibility make it a popular choice for businesses looking to streamline their financial operations.

Core Functionalities of Xero

Xero’s core functionality centers around automating and simplifying key accounting processes. Users can easily create and send invoices, track expenses, reconcile bank accounts, manage inventory, and generate various financial reports. The software integrates with numerous third-party apps, expanding its capabilities to include things like project management, CRM, and e-commerce platforms. This integration allows businesses to centralize their financial data and gain a more holistic view of their business performance.

Real-time data updates and collaborative features allow for improved team efficiency and better financial decision-making.

Xero Pricing Plans

Xero offers several pricing plans tailored to different business needs and sizes. Pricing varies by region and features included, but generally, plans range from basic packages suitable for freelancers and solopreneurs to more comprehensive options for larger businesses with multiple users and advanced features. The pricing typically depends on the number of users, features, and add-ons needed. For example, a small business might opt for a Starter plan, while a growing company might need a Premium plan to accommodate its increasing complexity and user needs.

It’s crucial to check Xero’s official website for the most up-to-date pricing information relevant to your location.

Comparison of Xero and QuickBooks

Both Xero and QuickBooks are leading accounting software solutions, but they cater to slightly different needs. Xero is often praised for its user-friendly interface and strong mobile app, making it particularly appealing to smaller businesses and those who prefer a more streamlined experience. QuickBooks, on the other hand, offers a broader range of features, including more robust inventory management and project tracking capabilities, which might be more suitable for larger or more complex businesses.

The choice between the two often comes down to individual business needs and preferences. Consider factors like the size of your business, the complexity of your accounting needs, and your budget when making a decision.

Key Features of Xero

| Feature Name | Description | Pricing Tier | User Benefits |

|---|---|---|---|

| Invoicing | Create and send professional invoices, track payments, and manage outstanding balances. | All plans | Improved cash flow management, faster payments, and reduced administrative overhead. |

| Expense Tracking | Easily record and categorize expenses, attach receipts, and track mileage. | All plans | Accurate expense reporting, simplified tax preparation, and better financial visibility. |

| Bank Reconciliation | Automatically reconcile bank transactions with your accounting records. | All plans | Reduced manual effort, improved accuracy, and timely financial reporting. |

| Financial Reporting | Generate various financial reports, including profit and loss statements, balance sheets, and cash flow statements. | All plans | Data-driven decision making, improved financial planning, and enhanced investor relations. |

Setting Up a Xero Account

Getting started with Xero is easier than you think! This section will walk you through creating your account, importing data, and customizing your dashboard for a seamless accounting experience. We’ll cover everything from initial signup to fine-tuning your workspace for maximum efficiency.

Creating a New Xero Account

The first step is to head over to the Xero website. You’ll need to provide some basic information, such as your business name, email address, and a password. Xero will then guide you through a series of questions to determine your business type and accounting preferences. This helps Xero tailor the platform to your specific needs, making navigation and data entry much smoother.

Remember to choose a strong password that you can easily remember, but that’s difficult for others to guess. After you’ve completed the signup process, Xero will send a verification email; click the link in that email to activate your account.

Importing Existing Financial Data into Xero

Once your account is active, you’ll want to get your existing financial data into Xero. This can significantly reduce the time you spend manually entering information. Xero offers several ways to import data, including uploading files (like CSV or Excel spreadsheets) or using third-party apps that integrate directly with Xero. The method you choose will depend on your current accounting system and the format of your data.

Before importing, it’s crucial to review and clean your data to ensure accuracy and avoid potential errors during the import process. For example, ensure that your account names are consistent and that your dates are correctly formatted. Xero provides detailed instructions and support to guide you through the import process.

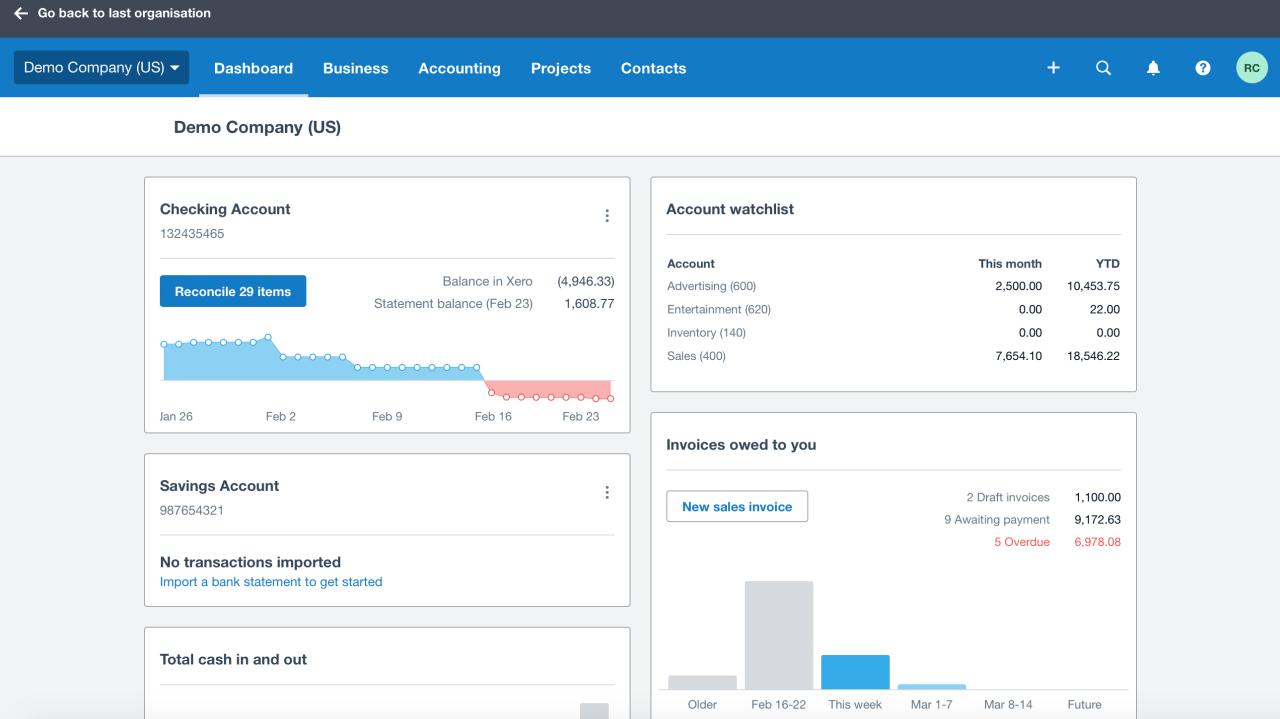

Customizing the Xero Dashboard

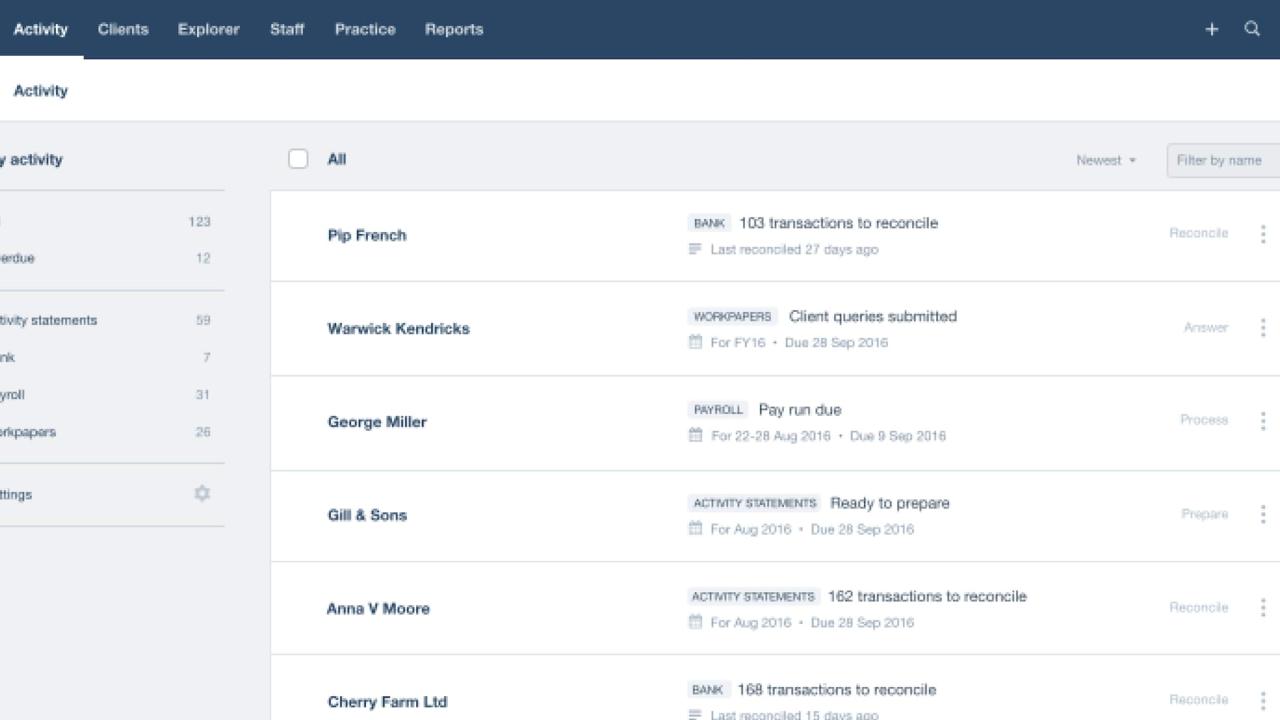

The Xero dashboard is your central hub for managing your finances. You can customize it to display the information most relevant to your workflow. This might involve adding shortcuts to frequently used features, rearranging panels, or choosing specific reports to track key metrics. For example, you could pin your bank reconciliation dashboard for quick access, or add a panel showing your upcoming invoices.

The ability to personalize your dashboard is key to improving efficiency and reducing the time spent navigating the software. Experiment with different configurations until you find a layout that best suits your needs.

Xero Account Setup Process Flowchart

Imagine a flowchart. The first box would be “Go to Xero Website”. An arrow points to the next box: “Enter Business Information & Create Account”. Another arrow leads to “Verify Email Address”. Then, “Login to Xero Account”.

Next, a decision box: “Do you have existing financial data?”. If yes, an arrow leads to “Import Data”. If no, the arrow skips to the “Customize Dashboard” box. Finally, an arrow from both paths leads to the final box: “Begin Using Xero”. Each box represents a step, and the arrows show the flow of the process.

This visual representation clarifies the straightforward steps involved in setting up your Xero account.

Managing Invoicing in Xero

Xero’s invoicing features are a game-changer for small businesses. Efficient invoicing means faster payments and better cash flow – things every entrepreneur dreams of. This section will walk you through creating professional invoices, tracking payments, and setting up recurring invoices to streamline your billing process.

Creating and sending professional invoices in Xero is surprisingly straightforward. The software allows for customization, ensuring your invoices reflect your brand identity and professionalism. This leads to a more positive client experience and ultimately, more efficient payment processing.

Professional Invoice Creation and Sending

Xero makes it easy to create invoices with all the necessary information. You can customize your invoice template with your logo, business details, and payment terms. Beyond the basics, Xero allows for the addition of line items, discounts, and taxes, all calculated automatically. Once created, invoices can be sent directly from Xero via email, saving you time and postage.

The system even allows for automated email reminders, minimizing late payments.

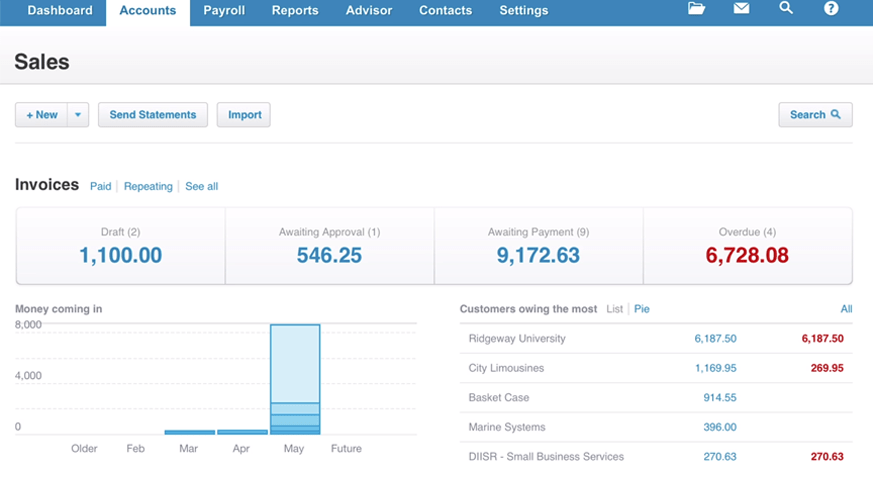

Tracking Outstanding Invoices and Managing Payments

Staying on top of outstanding invoices is crucial for maintaining healthy cash flow. Xero provides tools to monitor the status of each invoice, clearly showing which invoices are overdue, paid, or still outstanding. You can easily generate reports summarizing your receivables, giving you a clear picture of your financial position. When payments are received, you can record them directly within Xero, automatically updating the invoice status.

This integrated system eliminates manual data entry and reduces the risk of errors.

Recurring Invoices Setup

Recurring invoices are a lifesaver for businesses with regular billing cycles, like subscriptions or retainer agreements. Xero lets you create recurring invoices that are automatically generated and sent on a set schedule (weekly, monthly, quarterly, etc.). You can easily customize these invoices to reflect any changes in services or pricing, ensuring accuracy and consistency. This automated process frees up your time to focus on other important aspects of your business.

Sample Invoice

Imagine an invoice for Acme Corp, a fictional web design company, invoicing their client, Beta Solutions. The invoice would include:

Invoice Number: 20231027-001

Invoice Date: October 27, 2023

Due Date: November 26, 2023

Bill to: Beta Solutions, 123 Main Street, Anytown, CA 91234

From: Acme Corp, 456 Oak Avenue, Anytown, CA 91234

Description | Quantity | Rate | Amount

Website Design | 1 | $5,000 | $5,000

Content Creation | 10 | $100 | $1,000

Subtotal: $6,000

Sales Tax (6%): $360

Total: $6,360

Payment Terms: Net 30

Bank Reconciliation in Xero: Xero Accounting

Bank reconciliation in Xero is a crucial process for ensuring your financial records are accurate and up-to-date. It involves comparing your bank statement with your Xero records to identify any discrepancies and make necessary adjustments. This helps catch errors, prevent fraud, and provide a clear picture of your cash flow. Regular reconciliation is essential for reliable financial reporting and informed decision-making.Regular bank reconciliation helps maintain accurate financial records by identifying and correcting discrepancies between your bank statement and your accounting software.

This process is vital for catching potential errors, preventing fraud, and ensuring your financial reports reflect the true state of your finances. Failing to reconcile regularly can lead to inaccurate financial statements, impacting your business decisions and potentially leading to tax issues.

Steps Involved in Bank Reconciliation

Reconciling your bank account in Xero is a straightforward process. First, you’ll need to download your bank statement. Then, in Xero, navigate to the “Reconcile” section for the relevant bank account. Xero will present a comparison of your bank statement transactions with those recorded in Xero. You’ll review each transaction, marking them as reconciled in Xero once you confirm they match.

Any discrepancies will need to be investigated and addressed, which might involve adding new transactions in Xero or correcting existing ones. Finally, once all transactions are reconciled, the process is complete, and your bank account balance in Xero should match your bank statement.

Identifying and Resolving Discrepancies

Discrepancies between your bank statement and Xero can arise from various sources. For example, a transaction might appear on your bank statement but not yet be recorded in Xero (e.g., a recent deposit). Conversely, a transaction might be in Xero but not yet reflected on your bank statement (e.g., a check you’ve written but hasn’t cleared). Other discrepancies might result from data entry errors in either Xero or on your bank statement.

When discrepancies are found, you must investigate the cause. This may involve checking supporting documents like invoices, receipts, or bank statements for more detail. Once the cause is identified, you’ll need to correct the error in Xero, such as adding a missing transaction or adjusting an existing one.

Step-by-Step Guide to Resolving Common Reconciliation Issues, Xero accounting

Let’s say you’re reconciling and find a transaction on your bank statement that isn’t in Xero. First, you would verify the transaction details. Is it a legitimate business expense or income? If so, you’ll need to add the transaction manually in Xero. This usually involves creating a new transaction entry, specifying the date, amount, and account affected.

If the discrepancy is due to a data entry error in Xero, you’ll need to locate and correct the erroneous entry. For example, if an invoice was recorded for the wrong amount, you’d need to adjust the invoice amount in Xero. If you find a transaction in Xero that’s not on your bank statement, check if the transaction has cleared the bank yet.

If it hasn’t, you’ll likely need to wait until it does before reconciling that particular transaction.

Expense Tracking with Xero

Xero’s expense tracking features are a game-changer for small businesses, offering a streamlined way to manage and categorize spending, ultimately simplifying tax preparation. Understanding how to leverage these tools effectively can save you significant time and stress come tax season. This section will explore various methods for tracking expenses, best practices for categorization, and tips for optimizing your process for tax compliance.

Methods for Tracking Expenses in Xero

Xero offers several ways to record expenses, catering to different preferences and business needs. You can manually enter expenses directly into Xero, a great option for infrequent or unique expenditures. Alternatively, you can utilize bank feeds to automatically import transactions, minimizing manual data entry. This automated approach is ideal for high-volume transactions. Finally, Xero integrates with various receipt scanning apps, allowing you to capture expense details quickly and efficiently, often directly linking receipts to the corresponding expense entry.

The choice of method often depends on your business size and transaction volume.

Effective Expense Categorization in Xero

Proper categorization is crucial for accurate financial reporting and streamlined tax preparation. Xero allows you to create custom expense categories tailored to your business needs. For instance, instead of a generic “Marketing” category, you might have more specific categories like “Advertising,” “Social Media Marketing,” and “Public Relations.” Consistent and detailed categorization ensures accurate financial reporting and makes identifying areas of high spending much easier.

Think of it like creating a detailed organizational system for your financial life – the more detailed your categories, the clearer the picture of your finances.

Optimizing Expense Tracking for Tax Purposes

Optimizing your expense tracking for tax purposes involves meticulous record-keeping. Ensure every expense is properly categorized and supported by appropriate documentation, such as receipts or invoices. This is vital for claiming legitimate business deductions during tax season. Regularly reconcile your bank statements with Xero to catch any discrepancies early. By maintaining a well-organized system, you simplify the tax preparation process and minimize the risk of errors or omissions, potentially avoiding costly penalties.

For example, meticulously tracking mileage for business travel ensures you can accurately claim the appropriate deduction.

Best Practices for Managing Expenses in Xero

Effective expense management requires a proactive approach. Here are some best practices to follow:

- Regularly enter expenses: Don’t let expense entries pile up. Aim for daily or weekly input for better accuracy and easier tracking.

- Use descriptive expense descriptions: Avoid vague descriptions; include details that clarify the expense’s nature and purpose.

- Reconcile your accounts regularly: Monthly reconciliation is ideal to ensure your Xero data accurately reflects your bank statements.

- Implement a robust approval workflow: For larger expenses, establish an approval process to ensure accountability and prevent unauthorized spending.

- Utilize Xero’s reporting features: Regularly review your expense reports to identify trends and areas for potential cost savings.

Reporting and Financial Statements in Xero

Xero’s reporting features are a game-changer for small businesses. They go beyond basic accounting, providing tools to analyze your financial health and make informed decisions. Understanding how to generate and interpret these reports is crucial for managing your business effectively. This section will cover the key reports available and how they can help you.

Xero offers a wide variety of reports, all designed to give you a clear picture of your business’s financial performance. These reports range from simple summaries to detailed breakdowns of your income, expenses, and cash flow. The beauty of Xero is that you can customize many of these reports to fit your specific needs, allowing you to focus on the metrics most relevant to your business goals.

Types of Reports Available in Xero

Xero provides a comprehensive suite of reports categorized to help users quickly find what they need. These reports cover various aspects of a business’s financial health, providing a holistic view of performance. Key report categories include profit and loss statements, balance sheets, cash flow statements, and various other customized reports.

Generating Key Financial Statements

Generating key financial statements like profit & loss (P&L) statements and balance sheets in Xero is straightforward. Navigate to the “Reports” section within your Xero dashboard. From there, you’ll find options to select the specific report you need, and you can customize the date range to reflect the period you’re analyzing. For example, to generate a P&L statement, select “Profit & Loss” and specify the desired date range; the report will then be generated, displaying your revenue, expenses, and net profit for that period.

Similarly, the balance sheet shows your assets, liabilities, and equity at a specific point in time. You can easily download these reports in various formats like PDF or CSV for further analysis or sharing.

Using Xero Reports for Business Decision-Making

Xero reports are more than just snapshots of your finances; they’re powerful tools for strategic decision-making. For example, a trend analysis of your P&L statements over several months can reveal seasonal patterns in sales or identify areas where expenses are consistently higher than expected. This information can inform pricing strategies, cost-cutting measures, or even investment decisions. Similarly, analyzing your cash flow statement helps predict future cash needs and manage your working capital effectively.

By regularly reviewing and interpreting these reports, you can gain valuable insights into your business’s performance, identify areas for improvement, and make data-driven decisions to improve profitability and sustainability.

Report Types in Xero

The following table provides a summary of common report types in Xero, along with their descriptions. Remember that the specific reports and their availability may vary depending on your Xero plan and the features enabled.

| Report Name | Description |

|---|---|

| Profit & Loss (P&L) | Shows your income and expenses over a specific period, resulting in your net profit or loss. |

| Balance Sheet | Provides a snapshot of your assets, liabilities, and equity at a specific point in time, illustrating your financial position. |

| Cash Flow Statement | Tracks your cash inflows and outflows, highlighting your cash position and liquidity. |

| Aged Receivables | Shows outstanding invoices and their due dates, helping manage overdue payments. |

| Aged Payables | Lists outstanding bills and their due dates, aiding in managing supplier payments. |

| Trial Balance | A summary of all general ledger accounts and their balances, used for internal accounting checks. |

| Sales by Item | Details sales revenue generated by each item or product sold. |

| Expenses by Category | Categorizes expenses, providing a breakdown of spending across different areas. |

Xero Integrations and Add-ons

Xero’s power isn’t just in its core features; it’s also in its robust ecosystem of third-party apps. These integrations significantly expand Xero’s functionality, allowing businesses to tailor their accounting software to their specific needs and streamline various aspects of their operations. By connecting Xero with other tools, businesses can automate tasks, improve data accuracy, and gain valuable insights into their finances.Integrating Xero with other applications offers a huge boost in efficiency.

Imagine automatically importing invoices from your CRM, reconciling bank statements without manual data entry, or generating custom reports directly from your project management software. These integrations reduce the time spent on repetitive tasks, freeing up valuable time for more strategic activities. The overall result is a more efficient and informed approach to financial management.

Popular Xero Integrations

Many popular business applications seamlessly integrate with Xero. Some examples include CRM systems like HubSpot and Salesforce, project management tools like Asana and Trello, and e-commerce platforms like Shopify and WooCommerce. These integrations allow for a unified view of your business data, eliminating the need to manually transfer information between different platforms. This integration improves data accuracy and reduces the risk of errors.

Comparing Xero Add-ons Based on Functionality

Xero add-ons cater to a wide array of business needs. Some focus on specific industry requirements, such as those for construction or real estate. Others specialize in streamlining particular processes, like inventory management or time tracking. The choice of add-on depends entirely on a business’s unique operational requirements and desired level of automation. Consider factors like cost, ease of use, and integration strength when selecting an add-on.

For example, a small business might prioritize a simple invoicing add-on, while a larger company might need a more comprehensive solution for inventory management and project costing.

Top 5 Xero Integrations: Features and Benefits

Choosing the right integration can significantly improve efficiency. Here’s a comparison of five popular Xero integrations:

| Integration | Features | Benefits |

|---|---|---|

| HubSpot | Connects Xero to your CRM, automating invoice creation and payment tracking directly from customer interactions. | Improved sales efficiency, reduced manual data entry, better customer relationship management. |

| Shopify | Automates the import of sales data from your online store into Xero, simplifying reconciliation and reporting. | Streamlined accounting for e-commerce businesses, reduced manual data entry, accurate financial reporting. |

| Receipt Bank | Automates expense tracking by extracting data from receipts and invoices, minimizing manual data entry. | Reduced time spent on expense processing, improved accuracy, better organization of financial documents. |

| Xero Expenses | Allows employees to submit and track expenses directly within the Xero platform. | Simplified expense management, reduced paperwork, improved visibility into company spending. |

| Payroll integrations (e.g., Gusto, ADP) | Automates payroll processing and integrates payroll data directly into Xero. | Reduced time spent on payroll, improved accuracy, simplified financial reporting. |

Xero for Different Business Types

Xero’s adaptability is a key selling point. While it’s incredibly popular with small businesses, its features scale surprisingly well, making it a viable option for larger enterprises and diverse industries. Understanding how Xero adapts to different business needs is crucial for choosing the right accounting software.Xero’s core functionality remains consistent across various business sizes and sectors, but the depth of utilization and specific features leveraged vary significantly.

Smaller businesses might focus on basic invoicing and expense tracking, while larger enterprises might integrate Xero with more complex CRM and inventory management systems. The key difference lies not in the software’s capabilities, but in how comprehensively those capabilities are implemented.

So, Xero accounting is pretty slick, right? But if you’re looking for something with a more traditional feel, you might check out quickbooks desktop ; it’s a totally different beast. Ultimately, though, the best accounting software depends on your specific needs – Xero’s cloud-based features are a huge plus for many users.

Xero for Small Businesses vs. Larger Enterprises

Small businesses often find Xero’s ease of use and intuitive interface a major advantage. They typically use Xero for core functions like invoicing clients, tracking expenses, and generating simple financial reports. The streamlined nature of the software perfectly suits their needs, minimizing the time spent on accounting tasks and maximizing time spent on core business operations. Larger enterprises, however, often require more robust features, such as advanced reporting, multi-currency support, and integration with enterprise resource planning (ERP) systems.

They might utilize Xero’s API to connect with other business applications, creating a seamless workflow across various departments. For example, a small bakery might use Xero for basic invoicing and expense tracking, while a large multinational corporation might use Xero integrated with a sophisticated inventory management system and project accounting software.

Xero’s Adaptability Across Industries

Xero’s versatility shines through its ability to cater to various industries. A retail business might leverage Xero’s inventory management features to track stock levels, calculate cost of goods sold, and manage sales tax efficiently. A service-based business, like a consulting firm, might primarily use Xero for invoicing, expense tracking, and project profitability analysis. Manufacturing businesses can use Xero to manage inventory, track production costs, and generate comprehensive financial reports that help in making strategic decisions regarding production and pricing.

The key is that Xero provides the foundational tools; the specific application and level of complexity depend on the industry’s unique requirements.

Scalability of Xero

Xero’s scalability is a significant strength. As a business grows, it can seamlessly add users, customize reporting, and integrate additional features without needing to switch to a completely different system. This avoids the costly and time-consuming process of migrating data and retraining staff. For instance, a startup might begin with a basic Xero plan and gradually upgrade to a more comprehensive plan as its operations expand and its accounting needs become more complex.

This scalability allows businesses to optimize their Xero usage based on their current needs, without worrying about outgrowing the platform.

Examples of Xero Feature Utilization by Different Business Types

A freelance graphic designer might primarily utilize Xero’s invoicing and expense tracking features, leveraging its mobile app for convenient on-the-go accounting. A small restaurant could utilize Xero’s inventory management to track food supplies, while also employing its payroll functionality to manage employee wages. A larger construction company might integrate Xero with project management software to track project costs and profitability, generating detailed reports for clients and investors.

The adaptability of Xero allows each business to tailor its usage to its specific requirements, maximizing the platform’s value.

Xero Security and Data Protection

Keeping your business data safe is paramount, and Xero understands this. They employ a multi-layered approach to security, ensuring your financial information remains confidential and protected from unauthorized access. This includes robust infrastructure, advanced security protocols, and ongoing compliance with industry best practices.Xero’s security measures go beyond basic password protection. They utilize a combination of strategies to safeguard your data.

This commitment to security helps businesses of all sizes feel confident using Xero for their accounting needs.

Data Encryption and Infrastructure

Xero uses robust encryption methods to protect data both in transit and at rest. This means your data is scrambled and unreadable to anyone who intercepts it. Their infrastructure is built on secure data centers with multiple layers of physical and network security, including firewalls, intrusion detection systems, and regular security audits. This layered approach minimizes the risk of data breaches.

Compliance with Data Protection Regulations

Xero adheres to various international data protection regulations, including but not limited to GDPR (General Data Protection Regulation) in Europe and CCPA (California Consumer Privacy Act) in California. They have implemented policies and procedures to ensure compliance, providing users with control over their data and transparency in how it’s handled. This commitment to regulatory compliance demonstrates Xero’s dedication to responsible data management.

Best Practices for Securing a Xero Account

Maintaining a secure Xero account involves proactive steps from the user. Strong, unique passwords are crucial, and enabling two-factor authentication (2FA) adds an extra layer of security. Regularly reviewing user permissions within the account and promptly reporting any suspicious activity helps prevent unauthorized access. Staying updated on Xero’s security advisories and best practices also ensures optimal account protection.

For example, choosing strong passwords that combine uppercase and lowercase letters, numbers, and symbols, and changing them regularly, is a vital practice.

Recovering a Lost or Compromised Xero Account

If a Xero account is lost or compromised, Xero provides support mechanisms for recovery. Contacting Xero’s customer support is the first step. They will guide you through the verification process to confirm your identity and regain access to your account. This process may involve answering security questions or providing additional information to verify ownership. In cases of suspected unauthorized access, Xero will assist in securing the account and investigating the incident.

Prompt action is key in mitigating any potential damage.

Troubleshooting Common Xero Issues

Xero, while generally user-friendly, can sometimes present challenges. Understanding common errors and their solutions can save you valuable time and frustration. This section provides a practical guide to resolving some of the most frequently encountered Xero problems, empowering you to navigate any hiccups with confidence.

Common Xero Errors and Their Solutions

Many Xero issues stem from simple data entry mistakes or minor configuration problems. Let’s explore some frequent errors and their fixes. A methodical approach is key; carefully checking your data input is often the first and most effective step.

- Error: Incorrect Bank Reconciliation. This often occurs due to discrepancies between your bank statement and Xero’s records.

- Solution: Carefully review both your bank statement and Xero’s bank feed. Look for missing transactions, incorrect amounts, or transactions categorized incorrectly. Double-check transaction dates and descriptions.

Use the “Find & Match” function in Xero to help identify discrepancies.

- Solution: Carefully review both your bank statement and Xero’s bank feed. Look for missing transactions, incorrect amounts, or transactions categorized incorrectly. Double-check transaction dates and descriptions.

- Error: Invoice not showing up in a customer’s account. This can be caused by incorrect customer details, incorrect invoice number sequencing, or a simple oversight.

- Solution: Verify the customer’s contact information is accurate within Xero. Check the invoice number sequence to ensure it’s correct and that the invoice is properly marked as sent. If you’re still unable to locate the invoice, search for it using s from the invoice description.

- Error: Problems with Bank Feeds. Issues like incorrect bank account details or connection problems can interrupt the automated bank feed.

- Solution: Ensure the bank account details in Xero are correct and match your bank statement. Check your internet connection. If the problem persists, try reconnecting your bank account within Xero’s settings.

Contact your bank if you suspect a problem on their end.

- Solution: Ensure the bank account details in Xero are correct and match your bank statement. Check your internet connection. If the problem persists, try reconnecting your bank account within Xero’s settings.

Accessing Xero’s Support Resources

Xero offers a robust suite of support resources to assist users. Knowing where to find this help is crucial for efficient troubleshooting.

- Xero Central: This comprehensive online help center provides articles, FAQs, and video tutorials covering a wide range of topics. It’s often the first place to find answers to common questions.

- Xero Community Forum: Connect with other Xero users and share experiences, ask questions, and find solutions to problems. This peer-to-peer support can be incredibly valuable.

- Xero Support Phone and Email: For more complex issues, Xero offers phone and email support. Check your Xero plan to see what level of support is included.

Step-by-Step Troubleshooting Guide

A systematic approach is essential for effective troubleshooting. Following these steps can help you resolve most Xero issues efficiently.

- Identify the problem: Clearly define the issue you are experiencing. What is not working as expected?

- Check your data entry: Review all relevant data for accuracy. Are there any typos or incorrect entries?

- Consult Xero Central: Search for the error message or issue in Xero Central. Often, solutions are readily available.

- Use Xero’s built-in help features: Many Xero screens have help icons or links providing context-specific guidance.

- Contact Xero support: If you’re still unable to resolve the issue, contact Xero support for assistance.

Summary

So, there you have it – a comprehensive look at Xero accounting. From initial setup to advanced reporting, we’ve covered the essentials and beyond. Remember, mastering Xero isn’t just about using the software; it’s about understanding how it can empower your financial strategies and contribute to your overall business success. Embrace the power of automation, efficient reporting, and insightful data analysis to take your business to the next level.

Now go forth and conquer your finances!

Question Bank

Can I use Xero on my phone?

Yep! Xero has mobile apps for both iOS and Android, letting you access your accounts and manage your finances on the go.

What if I need help with Xero?

Xero offers excellent support resources, including online help articles, video tutorials, and phone support. They also have a thriving community forum where you can connect with other users.

Is Xero secure?

Xero employs robust security measures to protect user data, complying with various data protection regulations. Best practices like strong passwords and two-factor authentication are crucial for added security.

How much does Xero cost?

Xero offers several pricing plans to suit different business needs and sizes. Check their website for the most up-to-date pricing information.

Can I integrate Xero with other software I use?

Absolutely! Xero integrates with a wide range of third-party apps, streamlining your workflows and connecting your financial data with other essential business tools.